Locating Payday Loan Providers in Your Local Area

Locating Payday Loan Providers in Your Local Area

Blog Article

Unlock Financial Flexibility With an Online Cash Advance for Immediate Cash Money Demands

In a fast-paced world where economic emergencies can emerge suddenly, having access to immediate money can supply a complacency and tranquility of mind. On the internet payday advance loan have actually become a prominent option for people looking for fast options to their short-term monetary needs. With the ease of using from the convenience of your home and quick approval processes, these fundings use a way to link the space between incomes. However, there are very important factors to consider before selecting this financial tool. Recognizing the benefits, qualification needs, repayment terms, and accountable borrowing practices can aid individuals make educated decisions concerning their economic flexibility.

Advantages of Online Cash Advance Loans

On the internet payday financings supply a speedy and practical remedy for individuals dealing with immediate economic difficulties. Unlike traditional loans that might take days or also weeks to process, on-line payday finances frequently give approval within hours, with the cash transferred directly right into the borrower's bank account.

One more advantage of on-line cash advance is their availability. Many online lending institutions operate 24/7, permitting debtors to request a lending at any type of time of the day. This adaptability is especially helpful for individuals with hectic routines or those who call for funds beyond traditional banking hours.

Furthermore, online payday advance usually have marginal qualification demands, making them available to a large range of customers - payday loans near me. While typical lenders may need a good credit history or collateral, on-line cash advance loan providers frequently focus on a debtor's earnings and ability to settle the financing. This even more inclusive technique enables people with differing economic backgrounds to obtain the funds they require in times of crisis

Qualification Demands for Authorization

Satisfying the qualification requirements for approval of a cash advance car loan is contingent upon different variables that examine the applicant's economic security and capability to pay off the obtained amount. To certify for an on the internet cash advance loan, applicants typically need to fulfill certain criteria set by the lender.

Additionally, applicants may be required to give proof of identification, such as a government-issued ID, and evidence of income, such as pay stubs or financial institution statements. Meeting these eligibility demands is vital for the authorization of a payday advance loan, as they help lenders assess the applicant's capacity to settle the financing on time. By making certain that these needs are satisfied, applicants can increase their opportunities of being authorized for an on the internet payday lending to fulfill their instant money needs.

Fast Application and Authorization Process

Efficiency is extremely important in the application and approval procedure of acquiring an online cash advance for instant cash demands. When encountering immediate economic circumstances, a speedy application and authorization process can make all the distinction. On the internet payday advance service providers comprehend the necessity of the circumstance and have structured their processes to make certain quick accessibility to funds for those in requirement.

To start the application process, consumers normally fill out a straightforward on the internet type that calls for fundamental individual and financial information. This form is created to be easy to use and can usually be completed in a matter of minutes. When the kind is sent, lending institutions swiftly assess the information given to figure out qualification and evaluate the funding quantity that can be used.

Payment Options and Terms

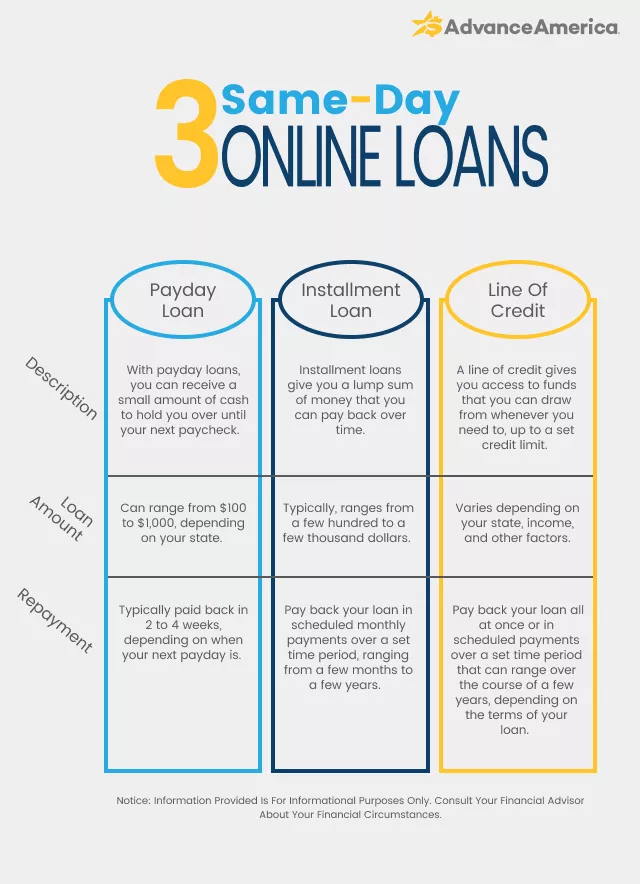

When taking into consideration an online payday advance for prompt cash demands, understanding the payment options and terms is vital for borrowers to manage their monetary commitments successfully. Typically, payday advance loan are temporary lendings that debtors have to repay on their next payday. Some loan providers use more versatility by allowing borrowers to expand the payment period or opt for installment payments.

Settlement terms for online payday advance vary amongst loan providers, so it's necessary for debtors to carefully evaluate and understand the specific terms described in the financing agreement. The settlement quantity typically includes the primary financing quantity plus any appropriate charges or interest costs. Customers ought to be mindful of the total amount and the due date they are anticipated to pay off to prevent any kind of possible late fees or penalties.

In addition, some lending institutions may provide alternatives for very early settlement without incurring added charges, allowing consumers to reduce rate of interest expenses by settling the lending sooner. Recognizing and sticking to the payment options and terms of an online payday advance loan can help borrowers successfully manage their financial resources and stay clear of falling under a cycle of financial obligation.

Tips for Responsible Loaning

In addition, customers need to completely read and recognize the terms and conditions of the financing, consisting of the repayment routine, rate of interest, and any added fees entailed. It is important to borrow from reputable loan providers that are clear regarding their borrowing methods and offer clear details about the total price of borrowing.

To avoid coming under a cycle of debt, debtors need to click to read avoid getting numerous cash advance all at once and abstain from making use of payday advance for lasting monetary issues. Accountable borrowing entails utilizing cash advances as a short-term option for urgent financial demands, as opposed to as a routine source of funding. By practicing sensible borrowing practices, individuals can successfully handle their finances and avoid unnecessary financial obligation.

Final Thought

Finally, on-line cash advance supply a convenient service for people dealing with instant cash demands. With quick application and authorization procedures, flexible payment alternatives, and minimal qualification needs, these loans supply monetary adaptability for borrowers. It is crucial to obtain properly and just take out a finance if definitely necessary index to prevent dropping right into a cycle of debt.

Unlike traditional lendings that may take days or even weeks to process, on the internet payday lendings commonly give authorization within hours, with the cash transferred straight right into the consumer's financial institution account. Meeting these eligibility demands is crucial for the authorization of a cash advance funding, as they assist loan providers evaluate the applicant's ability to pay off the financing on time (Where to find a Payday Loan). Normally, payday lendings are temporary finances that debtors should pay back on their next cash advance.Repayment terms for on the internet payday loans differ among lenders, so it's essential for consumers to very carefully evaluate and comprehend the certain terms described in the funding contract.To stop falling into a cycle of financial obligation, debtors need to stay clear of taking out multiple payday fundings all at once and abstain from using cash advance fundings for long-term economic issues

Report this page